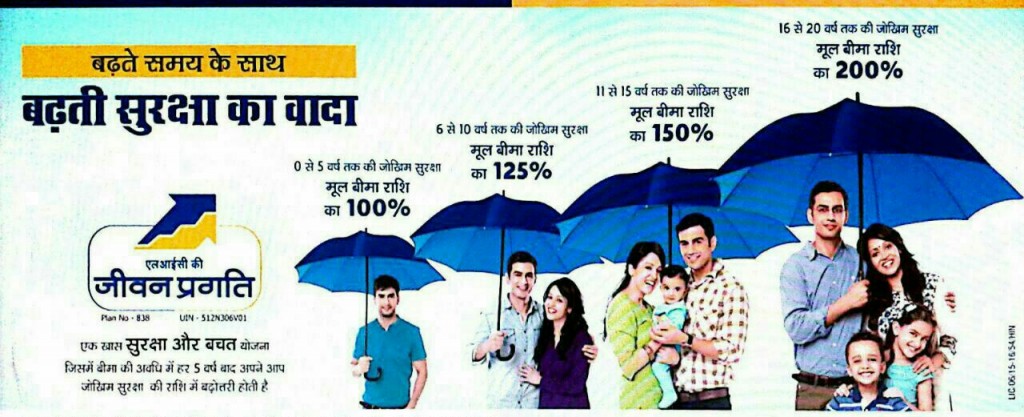

LIC’s Jeevan Pragati Plan is a non-linked, with – profits plan which offers a combination of protection and savings. This plan provides for automatic increase in risk cover after every five years during the term of the policy. In addition, this plan also takes care of liquidity needs through loan facility.

1. Benefits:

Death benefit : In case of death during the policy term, provided all due premiums have been paid, Death benefit, defined as sum of “Sum Assured on Death “, vested Simple Reversionary Bonuses and Final Additional bonus, if any, shall be payable. Where “Sum Assured on Death” is defined as the higher of 10 times of annualised premium or Absolute amount assured to be paid on death i.e. 100% of the Basic Sum Assured during first 5 policy years, 125% of the Basic Sum Assured during 6th to 10th policy years, 150% of the Basic Sum Assured during 11th to 15 th policy years and thereafter 200% of the Basic Sum Assured.

This death benefit shall not be less than 105% of all the premiums paid as on date of death.

Premiums referred above shall not include any taxes, extra amount chargeable under the policy due to underwriting decision and rider premium, if any.

Maturity Benefit: “Sum Assured on Maturity” equal to Basic Sum Assured, along with vested Simple Reversionary bonuses and Final Additional bonus, if any, shall be payable in lump sum on survival to the end of the policy term provided all due premiums have been paid.

Participation in Profits : The policy shall participate in profits of the Corporation and shall be entitled to receive Simple Reversionary Bonuses declared as per the experience of the Corporation, provided the policy is in force. The Bonuses shall be declared on the Basic Sum Assured.

Final Additional Bonus may also be declared under the policy in the year when the policy results into a claim either by death or maturity.

2. Optional Rider:

The policyholder has an option of availing LIC’s Accidental Death and Disability Benefit Rider. Rider sum assured cannot exceed the Basic Sum Assured.

Eligibility Conditions and Other Restrictions :

a) Minimum Basic Sum Assured : Rs. 1,50,000

b) Maximum Basic Sum Assured : No Limit

(The Basic Sum Assured shall be in multiples of Rs. 10,000/-)

c) Policy Term : 12 to 20 years

d) Minimum Age at entry : 12 years (completed)

e) Maximum Age at entry : 45 years (nearer birthday)

f) Maximum Maturity Age : 65 years (nearer birthday)

Date of commencement of risk : Under this plan the risk will commence immediately from the date of acceptance of the risk including minor lives.

Payment of Premiums:

Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly mode (through ECS or through salary deductions) over the term of policy.

However, a grace period of one month but not less than 30 days will be allowed for payment of yearly, half-yearly, quarterly mode and 15 days for monthly mode of premium payment.

Source: LIC India